As a business owner, or someone responsible for pricing products, accurately understanding your product costs are essential to determining a profitable wholesale price. This is where our wholesale price calculator comes in handy, as it can help you determine the right price point for your products by taking into account various factors such as production costs, shipping expenses, and desired profit margin. Wholesale pricing refers to the price at which you sell your products to retailers or other businesses, who then mark up the price for their own customers. Setting a wholesale price that is too high can make your products uncompetitive in the market, while setting a price that is too low can result in a loss for your business.

By using a wholesale price calculator and understanding your product costs, you can ensure that your business is able to generate a profit while also remaining competitive in the market. In this article, we will explore how to calculate wholesale price and the importance of accurately understanding your product costs in the process.

Landed Cost Calculation

Unit Cost

The unit cost is the Agreed upon price that you pay your factory. This field is required to make an accurate calculation of your landed cost.

Master Carton Information

Knowing the master carton dimensions and cube (Cubic Meters – CBM) is vital to determining the shipping cost for each unit. The number of pieces per master carton and the size of the master carton will be used to calculate a final freight rate. In our landed cost calculator we are assuming a 40 standard dry container for shipping costs. It is important to note that our calculation is using 56 CBM which is actually less than a full container. I do this because you can never fully load a container where you are not shipping air and wasting space. Based on my experience 56 CBM is a good approximation for what the capacity of a 40 foot container would actually be.

Master Carton Length – Inches (Required Unless You Know Your CBM):

The master carton length should be entered in inches. If you do not have this information you will need to manually enter your master carton CBM in the Master Carton CBM field below.

Master Carton Width – Inches (Required Unless You Know Your CBM):

The master carton width should be entered in inches. If you do not have this information you will need to manually enter your master carton CBM in the Master Carton CBM field below.

Master Carton Height – Inches (Required Unless You Know Your CBM):

The master carton height should be entered in inches. If you do not have this information you will need to manually enter your master carton CBM in the Master Carton CBM field below.

Master Carton CBM (Calculates from Master Carton; CBM Can Be Manually Entered):

This field is required in order for your freight rate to calculate to generate a landed cost. If you do not know your master carton dimensions than you can enter your master carton CBM to generate a landed cost.

Container/Shipping Cost

The container or shipping cost is important to calculate the amount you pay for freight per unit. You will be able to get this information from your freight forwarder. The more accurate your shipping cost is from your freight forwarder the more accurate your landed cost will be. If you are shipping a less than container load shipment (LCL) make sure that any additional fees and costs are included.

Duties and Tariffs

Duties and tariffs will be a critical factor when calculating your estimated total landing cost. It is important to note that you should verify the HTS code with a licensed customs broker to make sure that you accurately define what duties and tariffs you need to pay.

Duty Rate Percentage

The duty rate percentage is the amount of duty you will pay to customs. You can get your duty rate by working with your freight forwarder or asking your factory what HTS code they normally use for your product type. However, it is always best to verify your HTS code and the duty rate with a licensed custom broker. You definitely don’t want to get this wrong because if your duty is challenged you could end up owing the government money based on a wrong classification. The duty percentage is calculated off of your unit cost on your commercial invoice, and this tool works well as a customs cost calculator.

Tariff Rate Percentage

The tariff rate percentage is the amount of duty you will pay to customs. It is similar to the duty rate, but there is an additional tariff on your product. More than likely, this is due to additional Section 301 tariffs. You can get your tariff rate by working with your freight forwarder or a licensed customs broker as to whether additional tariffs apply to the HTS code you’re using. Like the duty rate, you definitely don’t want to get this wrong because if your tariff rate is challenged you could end up owing the government money based on a wrong classification. The tariff percentage is calculated off of your unit cost on your commercial invoice, and this tool works well as a customs cost calculator.

Miscellaneous Cost Percentage

The miscellaneous cost percentage is an undefined cost that you may want to add if there are additional costs to your product. For example, you may have an overseas agent commission that you need to pay or perhaps you have product testing or product inspection that you may need to include in your landed cost. This field is not required in the total landed cost calculation.

Freight Rate

The freight rate will automatically calculate once you hit the calculate button. Your freight rate will be factored taking your unit cost, master carton information and CBM, shipping costs, duties, and tariffs into consideration

Total Landed Cost Estimate

The total landed cost will also be calculate once you hit the calculate button. This estimate will be summed up from your unit cost, master carton information and CBM, shipping costs, duties, tariffs, any miscellaneous costs, and the calculated freight rate. This will be the number that you want to use as your estimated landed cost to start calculating your wholesale or selling cost.

Wholesale Price Calculation to Calculate Margin from Landed Cost

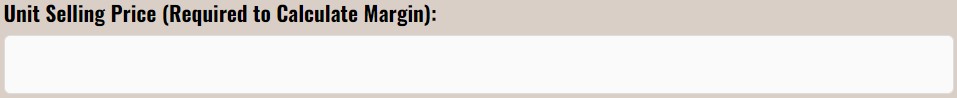

Unit Selling Price

The unit selling price is required to calculate your estimated margin and your total profit dollars per unit. This would be your desired selling price to your customer and can be edited at any time to see how your wholesale pricing impacts your margin.

Cost Factor Percentages (Fields 1 through 5)

The cost factors will play an important factor in calculator your overall margin. In these fields, you will put any of your fixed cost that go into the cost of your product. Some examples of costs you might put here is:

- Sales rep commission

- Overhead expenses

- Defective accruals

- Marketing allowances

- Markdown dollars

- Volume rebates

These costs will be factored based on the percent entered and calculated to determine your estimated margin and profit dollars

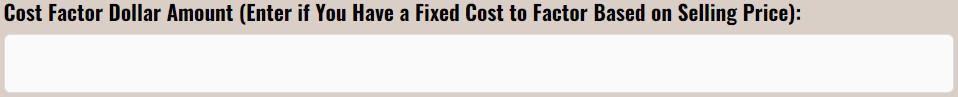

Cost Factor Dollar Amount

Like the cost factor percentages, the cost factor dollar amount is if you have a fixed cost in dollars you want to calculate into your margin. In some cases, you might want to go this road instead of using a percentage. Maybe you donate $1.00 of every sale to charity. Or maybe you need to accrue a fixed dollar cost to labor in the product. You’ll use this field to enter a cost in dollars if it applies to you.

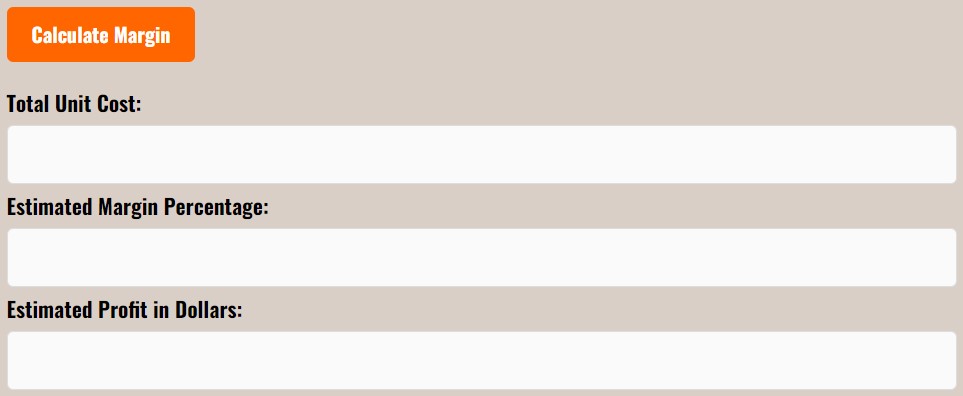

The Final Calculations

Lastly, when we hit the calculate margin button we’ll come up with our final results. You’ll see your total unit cost after all of the accruals you factored, your estimated margin percentage, and your estimated profit dollars per unit. You’ll be able to use this information to adjust your unit selling price up or down based on your margin requirements. There is no need to reset the form and start over – you can just go back to the unit selling price field and recalculate the margin at any time.

Conclusion

In conclusion, understanding your landed cost and accruals based on your selling cost is crucial when determining your wholesale pricing and calculating your margin. By factoring in multiple accruals you can accurately calculate the true cost of your product. This will help you determine the appropriate wholesale price for your product and ensure that you are making a profit.

Utilizing a wholesale price calculator can simplify this process and provide you with an accurate and efficient way to calculate your wholesale price. Knowing how to calculate your wholesale price will give you a competitive edge in the market and help you make informed decisions about your business. By taking the time to understand your landed cost and using a wholesale price calculator, you can increase your profit margins and ultimately grow your business.